Wholesale prices in the United States rose sharply in July, according to a Bureau of Labor Statistics (BLS) report released Thursday, raising the possibility that the Federal Reserve may hold off on cutting interest rates in September.

The producer price index (PPI), which measures prices received by producers for final demand goods and services, climbed 0.9% in July.

The figure was well above the 0.2% gain projected in a Dow Jones estimate.

Core PPI, which excludes food and energy costs, also rose 0.9%, compared to expectations for a 0.3% increase.

When further excluding trade services, the index advanced 0.6% — its largest gain since March 2022.

On a year-over-year basis, headline PPI increased 3.3%, marking the steepest annual rise since February and remaining above the Fed’s 2% inflation target.

The report attributed much of the upward pressure to higher services costs, which rose 1.1% in July, also the largest increase since March 2022. Trade services margins were up 2%, amid developments linked to President Donald Trump’s tariff policies.

About 30% of the overall services gain came from a 3.8% increase in machinery and equipment wholesaling.

Market reaction and bond yields

Stock index futures declined following the release of the data. S&P 500 and Nasdaq 100 futures were each down 0.4%, while futures tied to the Dow Jones Industrial Average fell by 167 points, or 0.4%.

In the bond market, the yield on the 2-year Treasury note edged higher by one basis point to 3.693%.

The benchmark 10-year yield held about one basis point lower at 4.233%. Yields and prices move in opposite directions, and one basis point equals 0.01 percentage point.

What does it mean for a rate cut?

PPI is generally watched less closely than the consumer price index (CPI), but it offers insight into pipeline inflation.

Both indicators contribute to the Commerce Department’s personal consumption expenditures price index, the Fed’s preferred inflation gauge, which will be updated later this month.

Earlier this week, CPI data came in close to expectations, leading markets to anticipate a rate cut in September. The latest PPI figures may challenge those expectations.

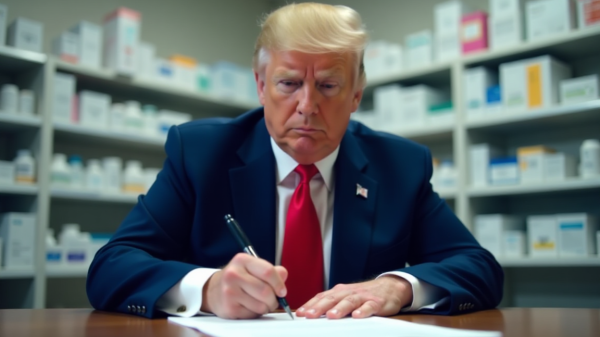

The report comes as questions grow over the reliability of BLS data.

President Donald Trump recently dismissed the agency’s former commissioner and announced plans to nominate Heritage Foundation economist EJ Antoni as the next head.

Antoni has been critical of the bureau’s reporting and has suggested suspending the monthly nonfarm payrolls release until data accuracy is addressed.

Budget reductions and staff layoffs have already forced changes in BLS data collection methods.

The July PPI report was the first to reflect the elimination of around 350 categories from its detailed count of input costs.

The post Wholesale inflation surges in July, potentially complicating Fed’s rate cut plans appeared first on Invezz