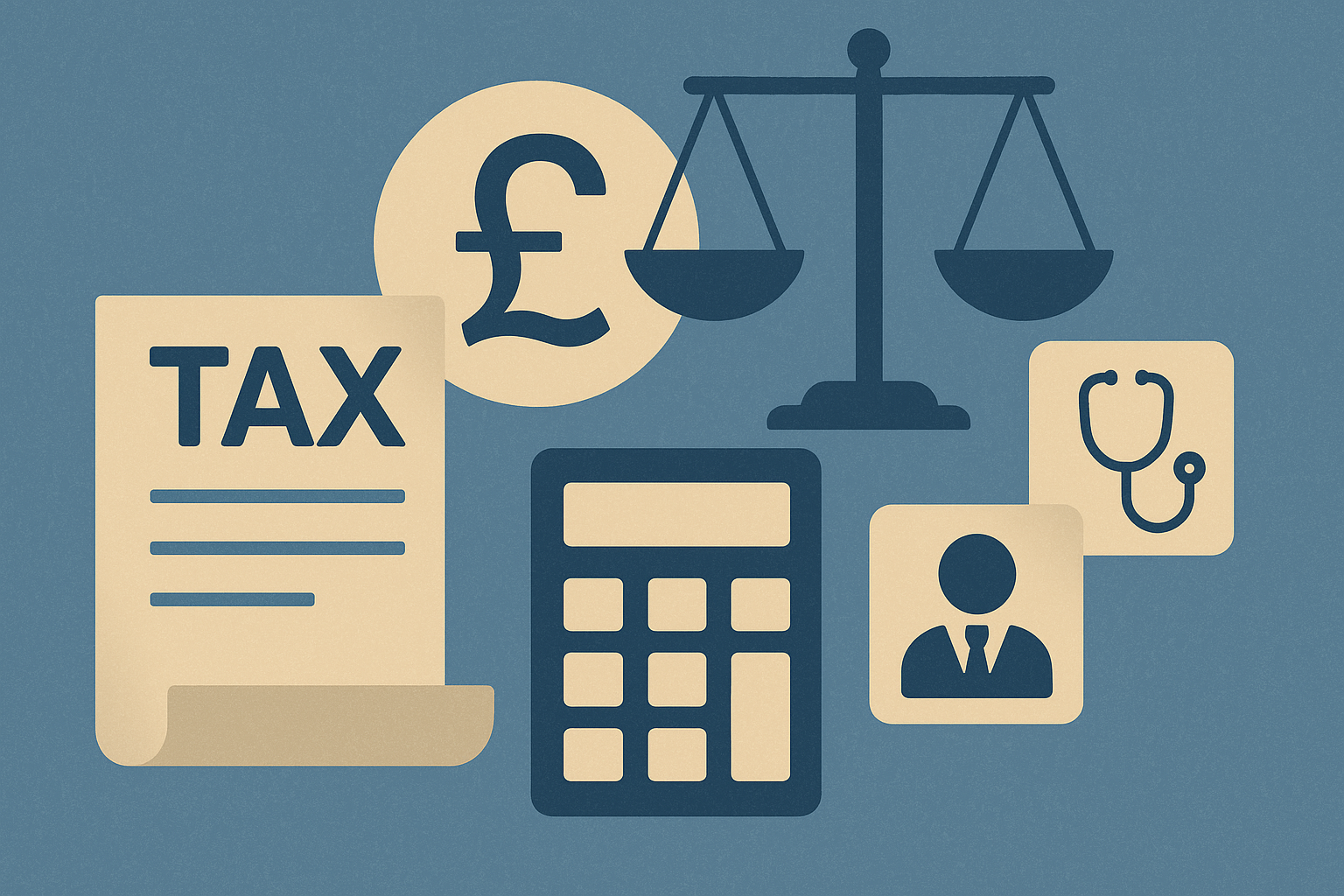

Britain’s finance minister Rachel Reeves is reportedly exploring changes to how Limited Liability Partnerships (LLPs) are taxed, in a move that could have sweeping consequences for professionals in law, accounting, and healthcare.

The proposal, reported by The Times, comes as the Treasury faces a shortfall of up to £30 billion ahead of the 26 November budget.

The plan under discussion could see partners in LLPs — currently treated as self-employed — being made subject to employer national insurance contributions.

Experts suggest that while this may help boost revenue, it could also reshape the tax landscape for nearly 200,000 professionals across the UK.

Government weighs LLP tax changes amid fiscal pressure

Reeves’ reported plan is part of a wider effort to close the fiscal gap without directly raising income tax, VAT, or national insurance for employees.

According to estimates from the Centre for the Analysis of Taxation, the proposed LLP reform could raise about £1.9 billion.

However, industry groups warn that the move may have unintended effects.

The Law Society of England and Wales, representing solicitors nationwide, argues that such a measure could weaken sectors central to the government’s own growth ambitions.

Legal and accounting firms, already grappling with inflation-driven costs and potential new regulations, could face added strain under higher tax liabilities.

LLPs have long been the preferred structure for professional firms because they offer flexibility while maintaining liability protection.

Changing their tax status, economists say, would narrow the gap between self-employed professionals and incorporated entities — a move seen by some as aligning the system with broader fairness principles.

Legal and healthcare sectors brace for possible ripple effects

The proposal’s reach extends beyond law and finance. Family doctors who operate under LLPs could also be affected, potentially altering partnership structures within medical practices.

Reports indicate that the Treasury is exploring whether to exempt general partnerships, which could exclude some doctors but not lawyers or accountants — a distinction experts warn could lead to inconsistencies and economic distortion.

The government has yet to confirm whether these deliberations will translate into concrete legislation in November’s budget.

But given the potential to raise significant revenue, analysts believe the proposal remains under serious consideration.

Fiscal reform faces test of balance and growth

Reeves’ challenge lies in balancing fiscal responsibility with the Labour government’s promise of sustainable growth.

By targeting LLPs, the Treasury could gain a short-term revenue boost, but critics warn it may risk discouraging investment and expansion among professional service firms.

Industry observers argue that law partnerships, in particular, already lack access to tax incentives available to other business models.

Adding further liabilities could, they say, discourage recruitment and innovation in a sector vital to Britain’s global reputation for legal and financial services.

The debate underscores a broader question about how the UK can reform its tax base without undermining productivity or competitiveness.

With the November budget weeks away, attention is turning to whether the government will proceed with the measure, modify it to protect key professions, or explore alternative ways to bridge the £30 billion gap.

The post Reeves’ proposed LLP tax reform could reshape UK’s £1.9B professional sector appeared first on Invezz