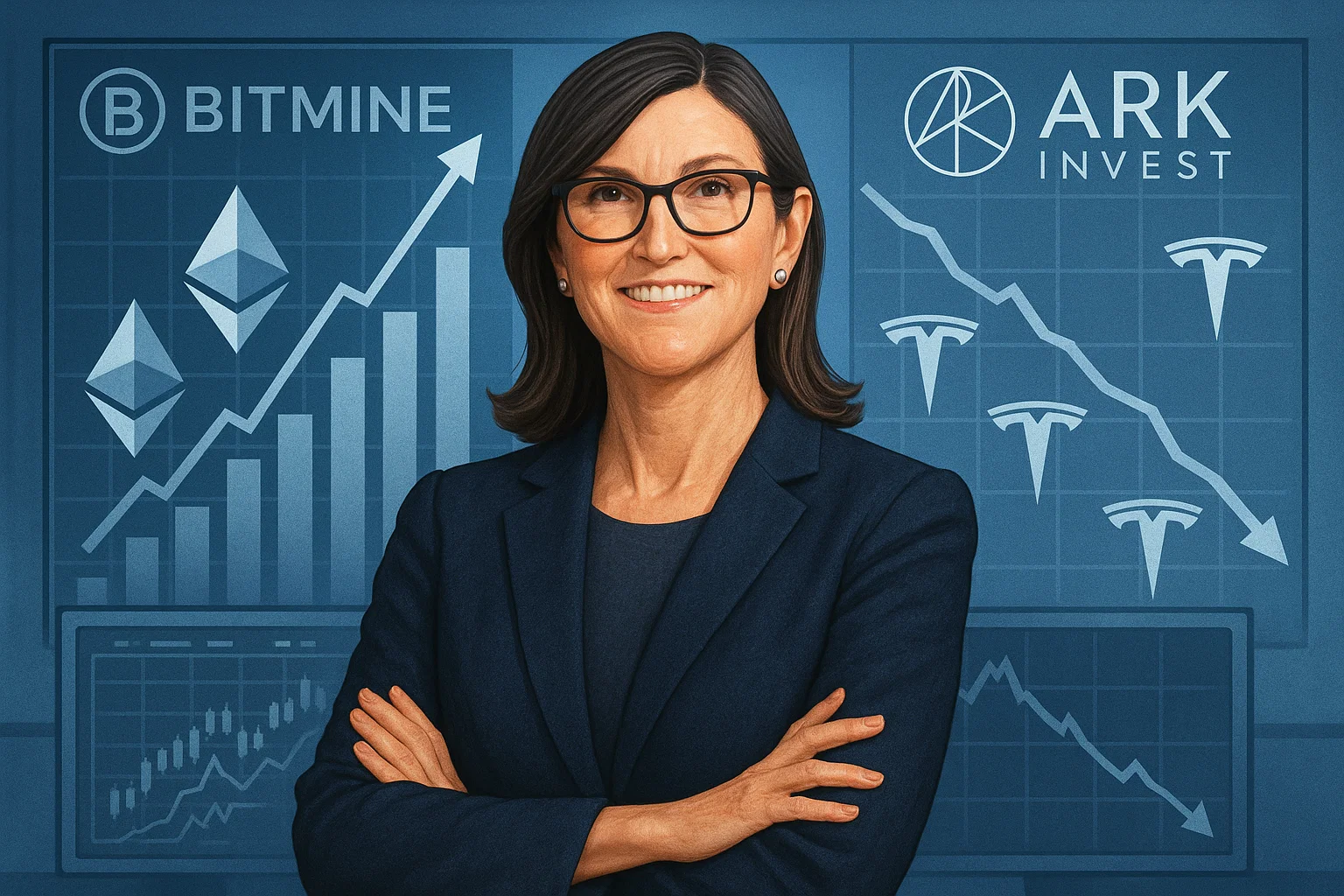

Cathie Wood’s ARK Invest has expanded its investment in BitMine, the Ether treasury company founded by Tom Lee, while paring back its long-standing exposure to Tesla.

The moves, disclosed in ARK’s daily trading update on Friday, highlight the firm’s shifting focus toward digital asset infrastructure and diversification away from some of its traditional high-conviction positions.

ARK Invest increases exposure to BitMine

According to the firm’s trading disclosure, ARK purchased a combined 48,454 shares of BitMine, valued at around $2 million, across three of its exchange-traded funds, the ARK Innovation ETF (ARKK), the ARK Fintech Innovation ETF (ARKF), and the ARK Next Generation Internet ETF (ARKW).

The investment marks ARK’s continued accumulation of BitMine shares since the company began adding Ether (ETH) to its balance sheet as a treasury reserve earlier this year.

BitMine’s strategy of holding Ether as a primary asset has drawn investor attention, positioning it as a key player in the growing intersection of corporate treasuries and blockchain technology.

Shares of BitMine surged 7.65% on Friday to $40.23 in after-hours trading.

The stock has climbed 474% since the beginning of 2025, making it one of the best-performing digital asset-related equities of the year.

ARK trims Tesla stake amid portfolio rotation

In contrast, ARK Invest reduced its position in Tesla Inc., selling 71,638 shares across its ETFs — a stake worth approximately $30 million based on Tesla’s Friday closing price of $429.52.

The sale affected holdings within both the ARKK and ARKW funds, which have held Tesla as a core position since 2018.

Tesla’s stock fell 3.68% on the day, following news that shareholders had approved CEO Elon Musk’s nearly $1 trillion pay package.

The plan backed by about 75% of voting shares, despite opposition from proxy advisors Glass Lewis and ISS, ties Musk’s compensation to 12 tranches of stock options, contingent on performance milestones ranging from a $2 trillion to $8.5 trillion market capitalization.

If achieved, the package would increase Musk’s ownership stake from roughly 13% to 25%, further cementing his control over the electric vehicle manufacturer.

BitMine faces $2.1 billion in unrealized Ether losses

Despite strong equity performance, BitMine’s balance sheet faces mounting pressure from the ongoing decline in crypto markets.

According to CryptoQuant, the firm currently sits on approximately $2.1 billion in unrealized losses tied to its Ether holdings.

BitMine holds nearly 3.4 million ETH, having added more than 565,000 Ether in the past month, reflecting an aggressive accumulation strategy despite market volatility.

The company’s approach mirrors that of corporate pioneers such as MicroStrategy in Bitcoin, though it exposes the balance sheet to sharp fluctuations in crypto valuations.

As digital asset markets remain volatile, ARK’s decision to increase its exposure to BitMine signals continued conviction in blockchain-based corporate finance models, even as it trims exposure to traditional technology leaders like Tesla.

The post Cathie Wood’s ARK Invest boosts BitMine stake, trims Tesla holdings appeared first on Invezz