Market expert Len Yaffee says it would be increasingly difficult for Eli Lilly (NYSE: LLY) to push higher from current levels – at least in the near-term.

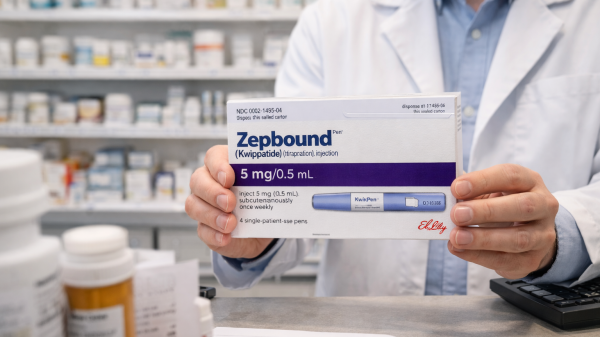

LLY shares have been standout performers in 2025 – riding the wave of investor enthusiasm around its obesity and diabetes drugs (Zepbound and Mounjaro).

Despite solid demand for the treatments, however, the chief executive of Kassef Capital says don’t expect much from Eli Lilly stock heading into 2026.

At the time of writing, the pharmaceutical behemoth is up roughly 75% versus its year-to-date low.

Merck’s MariTide could weigh on Eli Lilly stock

One of the biggest near-term risks for LLY stock is competition from Merck’s experimental obesity drug, MariTide.

While still in Phase 2 trials, the drug has generated excitement because of its potential as a once-a-month injection, compared to Lilly’s weekly dosing regimen.

Yaffee noted that “the issue surrounding MariTide isn’t so much the efficacy but the side effect issue,” particularly nausea and vomiting. If upcoming data shows tolerable safety, investors may view MariTide as a credible threat.

Even though FDA approval isn’t expected until 2028 or 2029, he cautioned that strong trial results could trigger profit-taking in Eli Lilly shares in the short term.

The timing may limit Merck’s ultimate market share, but the mere prospect of competition could weigh on the NYSE-listed giant in the near term.

LLY shares are trading at stretched valuation

Another hurdle for Eli Lilly stock is the valuation. The company trades at nearly 35 times forward earnings, a steep premium compared to peers like Merck and Bristol Myers, which trade closer to 11–12 times.

In fact, that sort of forward multiple is typically reserved for the high-growth artificial intelligence (AI) stocks.

Speaking with CNBC, Yaffee acknowledged that Lilly deserves a premium given its leadership in obesity drugs, but he questioned how much higher investors can realistically push the stock.

“My estimate for next year is $35 per share. So it’s at about 31 times my estimate,” he explained.

With LLY shares already trading at his long-term price target of $1,100, Yaffee believes they may need years of earnings growth before they can justify another leg higher.

The pharmaceutical sector is undergoing what he calls a “research renaissance,” but Eli Lilly’s valuation already reflects much of that optimism.

For investors, the risk is that any hiccup in clinical data or slower-than-expected uptake could trigger sharp corrections.

Technicals also warrant caution on Eli Lilly

From a technical perspective as well, Eli Lilly shares do not particularly inspire investment in the near-term.

Their relative strength index (20-day), at the time of writing, sits at over 80 – signalling the bullish momentum is now near exhaustion.

Finally, LLY stock is trading comfortably above Wall Street’s mean target of roughly $1,087, substantiating that much of the upside is baked in already.

The post Don’t expect much from Eli Lilly stock anymore, says Len Yaffee appeared first on Invezz