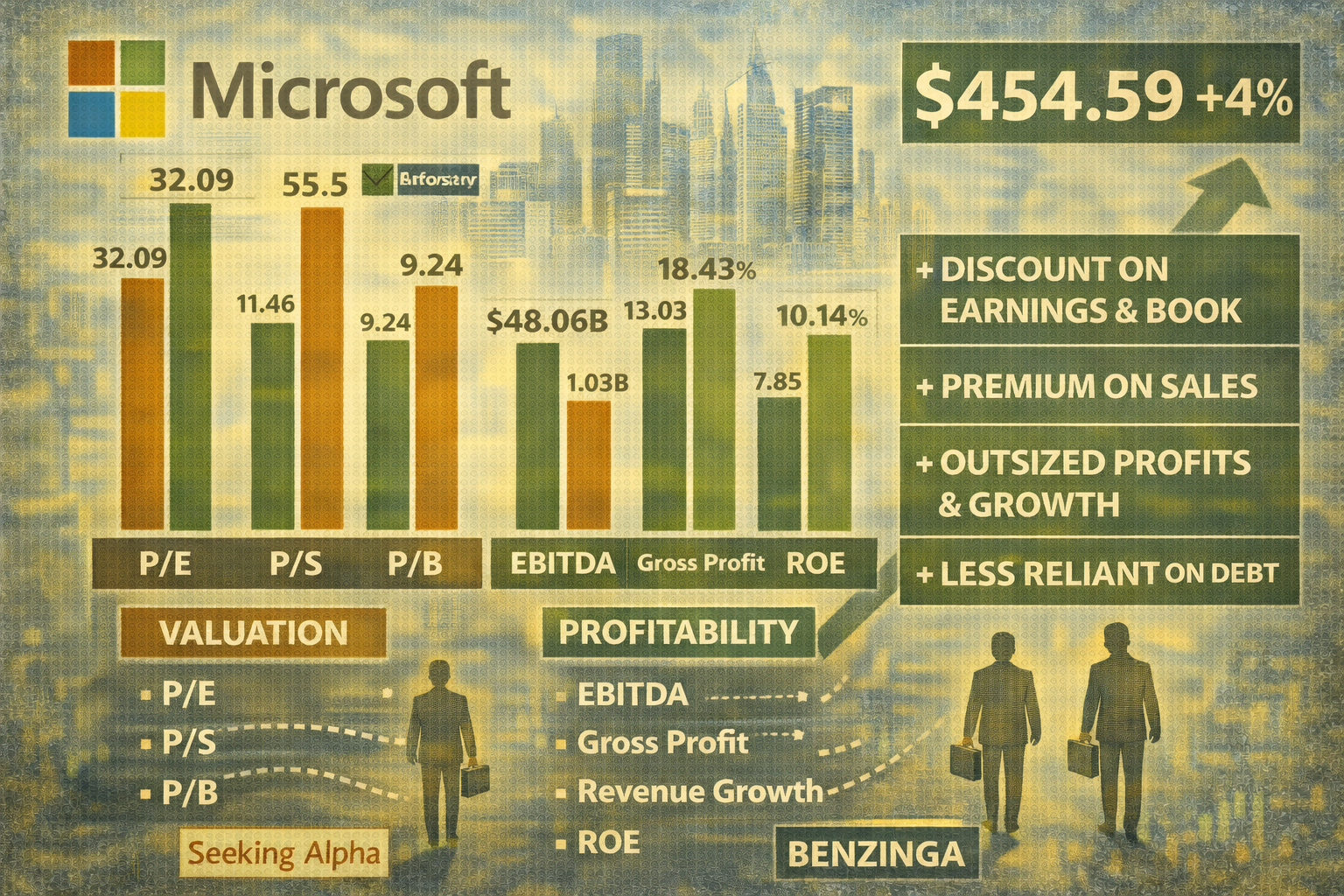

Microsoft stock (NASDAQ: MSFT) jumped about 4% today, putting the tech heavyweight back in the spotlight as investors reassess both its fundamentals and its valuation.

An industry comparison from Benzinga suggests Microsoft continues to stand out versus software peers on growth, profitability, and balance sheet strength, even as the signals across valuation metrics remain mixed.

With shares recently trading around the mid-$450s, the key question for markets is whether this rally reflects durable earnings power or simply renewed enthusiasm priced in.

Microsoft stock: what is happening and why it matters

Benchmarking Microsoft against major software names, Benzinga reports a Price to Earnings ratio of 32.09 versus an industry average of 55.5 and a Price to Book of 9.24 versus 15.9, suggesting a discount on earnings and book value.

Its Price to Sales of 11.46 exceeds the 6.62 average, pointing to a richer sales multiple.

The company’s EBITDA of $48.06 billion and gross profit of $53.63 billion far surpass industry averages, and revenue growth of 18.43% is ahead of the 13.03% peer baseline.

Shares recently traded at $454.59, up 0.76%, according to Benzinga.

Seeking Alpha notes the stock has fallen roughly 12% since a prior bullish write-up despite recent positive earnings surprises and estimate revisions, framing an ongoing debate around valuation and momentum.

Valuation and profitability metrics

On valuation, Microsoft’s P/E of 32.09 and P/B of 9.24 are below the industry averages of 55.5 and 15.9, respectively, indicating comparatively lower pricing on earnings and book value.

Its P/S of 11.46 is well above the 6.62 average, implying a premium on revenue relative to peers.

Return on equity stands at 7.85% versus the 10.14% industry average, which suggests lower equity efficiency.

However, profit scale is a clear differentiator.

Benzinga’s data shows EBITDA of $48.06 billion versus an industry average of $1.03 billion and gross profit of $53.63 billion versus $1.59 billion, highlighting substantial operating heft and cash generation.

Growth and competitive context

Microsoft’s revenue growth of 18.43% outpaces the industry average of 13.03%, signaling continued sales expansion.

Benzinga’s peer set spans large and mid-cap software and security companies, offering a broad frame of reference for these comparisons.

The company operates across three segments, according to Benzinga: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing.

That mix underscores exposure to enterprise software, cloud infrastructure, and consumer platforms.

Benzinga reports a debt-to-equity ratio of 0.17, lower than the top four peers it compared, indicating less reliance on debt financing and a relatively stronger balance sheet position.

Recent stock performance

Per Benzinga, the stock was at $454.59, up 0.76%.

According to Seeking Alpha, shares have declined roughly 12% since a prior bullish analysis, even as the company delivered positive earnings surprises and estimate revisions in recent months.

That divergence between fundamentals and price performance is a focal point for investors assessing risk and reward.

Benzinga’s data shows Microsoft trading at a discount on earnings and book, a premium on sales, and delivering above-average growth with strong profit scale and low leverage.

According to Seeking Alpha, the stock’s recent pullback despite beats and upward revisions keeps attention on how far the current multiples can stretch relative to peers.

The post Microsoft stock rebounds 4% as Wall Street reassesses valuation and momentum appeared first on Invezz