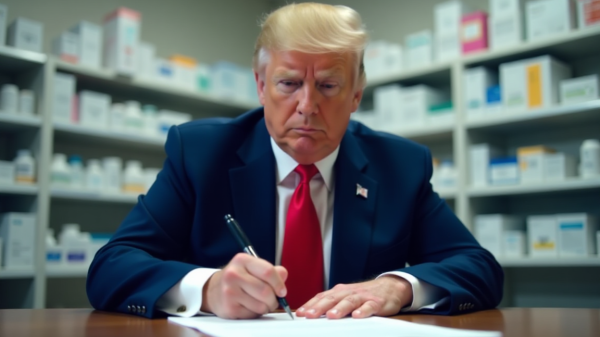

Kevin Hassett, director of the US National Economic Council, is solidifying his position as the clear frontrunner to become the next chair of the Federal Reserve, according to market pricing and a recent report by Bloomberg.

Traders are increasingly betting that President Donald Trump will appoint Hassett to replace Jerome Powell when his term expires in May 2026, a shift that could signal a more dovish monetary direction for the central bank.

Markets price in Hassett as favorite for Fed leadership

Prediction markets on Kalshi now reflect a 54% probability that Hassett will be chosen to lead the US central bank, a notable rise over the past 24 hours.

This places him ahead of other previously discussed contenders, including Fed governor Christopher Waller and former governor Kevin Warsh, both of whom have lost ground in recent weeks.

The move in market pricing closely followed a Bloomberg report indicating that Hassett is viewed by Trump advisers and allies as the leading candidate for the role.

Observers note that his alignment with the former president’s preference for faster rate cuts enhances his appeal as Powell’s potential successor.

Alignment with Trump’s rate outlook boosts his case

Hassett’s prospects are tied in part to his stance on monetary policy.

He has been described as sharing Trump’s view that interest rates should be cut more aggressively, a position that contrasts with expectations for a gradual easing cycle under current Fed leadership.

The Federal Reserve is anticipated to reduce the policy rate by 25 basis points to a range of 3.50% to 3.75% after its December 10 meeting.

However, forecasts only see rates declining to roughly 3% by the end of 2026.

Trump has previously indicated that he favors deeper cuts than the current trajectory suggests, raising speculation that a shift in leadership could alter the path of monetary policy.

Market reaction has been swift.

Expectations of a more dovish Fed contributed to a decline in 10-year Treasury yields, which briefly fell below 4% on Tuesday before inching slightly higher again.

Bond yields move inversely to prices, and even a modest repricing reflects the growing perception of a possible policy shift.

Kyle Rodda, senior financial market analyst at Capital.com, described Hassett as “a noted dove and a Trump loyalist,” suggesting he may support keeping interest rates lower than they might otherwise be.

Rodda said in a Market Watch report that the combination of leadership rumors, softer US economic data, and warming geopolitical signals helped weaken the dollar while pushing yields down as investors priced in the possibility of easier policy ahead.

A potentially pivotal leadership transition

The increasing likelihood of a change at the Federal Reserve comes at an especially delicate moment for markets.

The central bank’s upcoming December rate decision carries heightened importance, with US equities experiencing their sharpest November decline since 2008.

A shift in leadership could influence not only the pace of rate adjustments but also the broader policy outlook heading into a period marked by uncertainty in growth, inflation, and global economic conditions.

The post Betting markets increase odds on Kevin Hassett to succeed Powell as Fed chair appeared first on Invezz